When dealing with different currencies, there is one company that instantly comes to my mind: Wise. Wise offers multiple services such as sending different currencies, receiving & holding currencies in different local bank accounts (Borderless accounts) and a debit card that uses the balances in the Borderless account to your advantage. Read on to learn more about the various services and if they may be interesting for you.

TransferWise changed its name to just Wise in March 2021.

Sending Money in Different Currencies

I discovered Wise the first time years ago when I was looking for cheap ways to transfer into foreign currencies. There are some advantages of using Wise compared to other services:

- Fees are extremely low

- You can send the exact amount in a foreign currency

- You can pay via bank transfer, credit card or debit card (amongst other options)

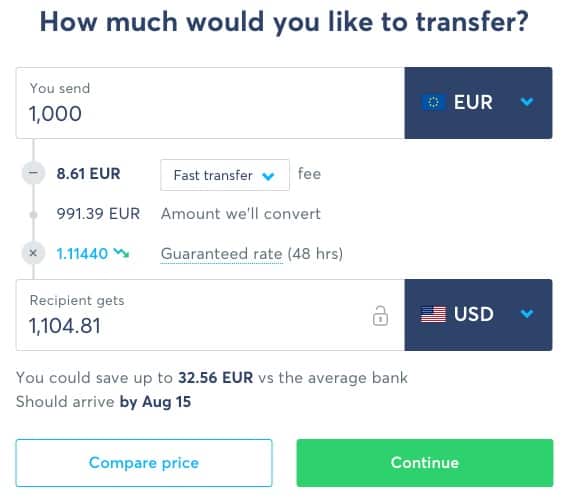

I really like the initial transfer form that lets you choose which currency you want to pay with and into which currency you want it to be transferred. You can change either amount. Therefore you have two options when sending money:

- Send a certain amount in your local currency to the receiver (who will end up with more funds in their local currency than with a regular bank transfer because of the low Wise fees)

- Send a certain amount in the local currency of the receiver. In this case, you will cover the fees as those will be added to the amount you have to pay in your own local currency.

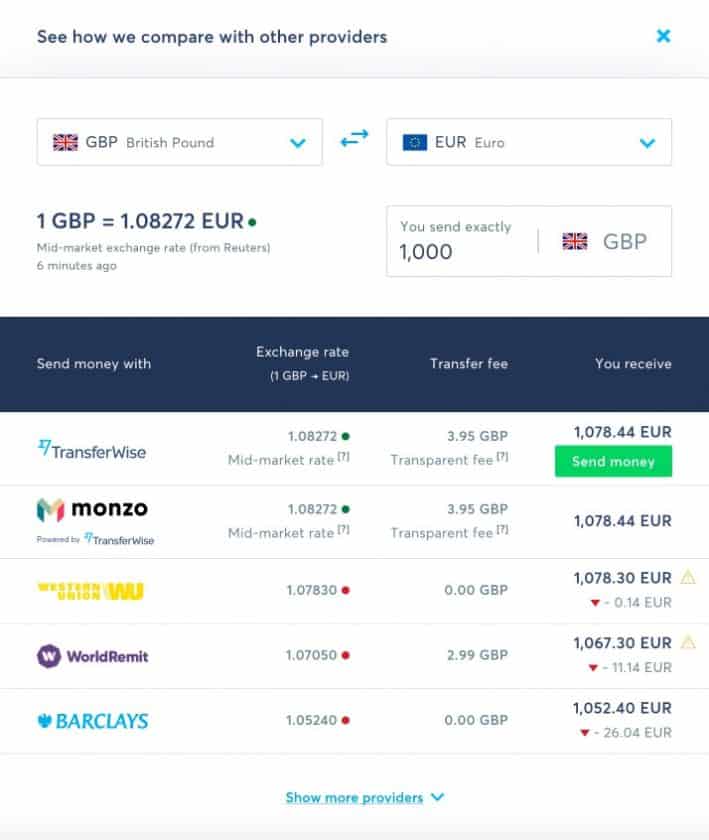

I used to use PayPal to send and receive funds but to be honest, PayPal’s fees are horrendous. Wise offers functionality to compare their price to other competitors, and you will see that other providers are mostly more expensive.

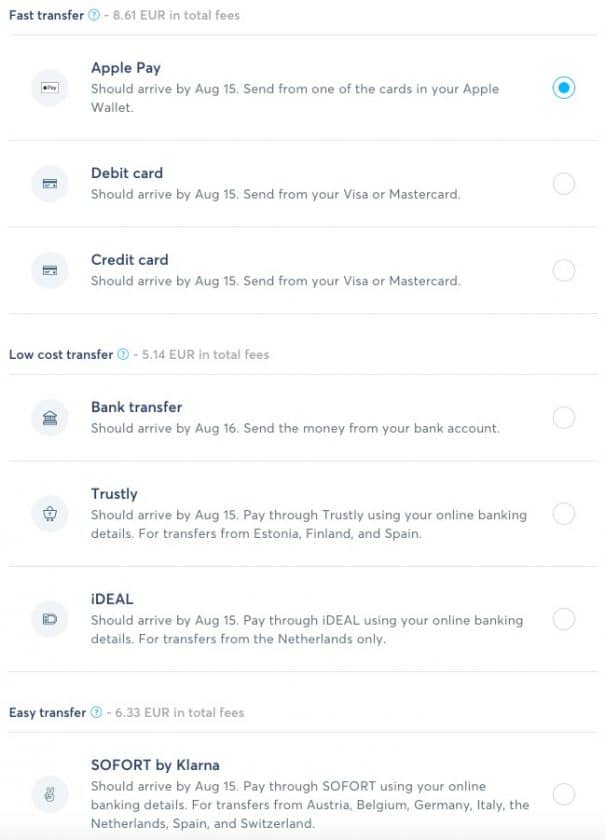

After entering the details of the recipient and reviewing your transfer, you can pay for the amount in various ways:

The total fees are extremely low, and even the most expensive option costs less than 1% in fees. Now, some of you guys obviously like to use their credit cards to generate miles on their favorite frequent flyer programs, and this can be an excellent way to do so. Unfortunately, American Express cards are not supported (also not through Apple Pay). However, Visa and Mastercard cards are.

If you sign up through this link, your first transfer of up to GBP 500 is going to be free. In exchange, we will receive a referral bonus. A win-win situation!

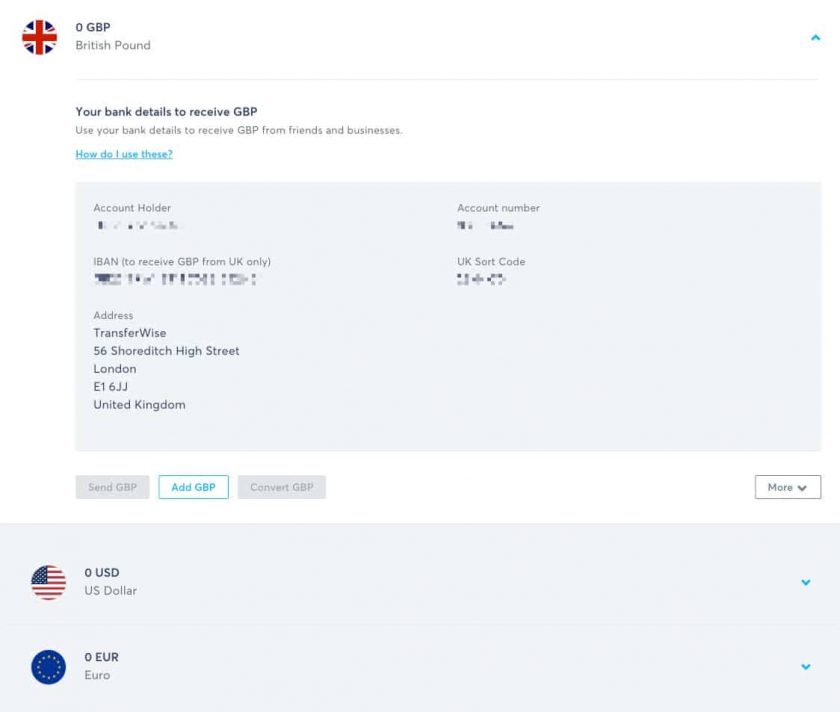

Borderless Account

I clearly remember receiving an email from Wise in May 2017 announcing their Borderless account. I got very excited and immediately signed up. The idea behind the Borderless account is best described by quoting Wise and how they explained it in their initial email:

It’s a new breed of account designed to make living, travelling, and sending money internationally painless. It does that by working just like a local account, in many different countries.

The advantages are:

- Receive money with zero fees and get local bank account details in the following countries:

- Australian account number and BSB code

- British account number and sort code

- European IBAN

- US account number and routing number

- New Zealand account number

- Hold and convert 40+ currencies.

This can be useful if you get paid in other currencies than your own and also spend in other currencies than your own.

This is beneficial if you want to receive payments but don’t want the sender to use Wise for that and instead want him to pay like he would pay a local. That way it is easier for him, and you can later on just transfer the amount into your local bank account at Wise’s reasonable rates. That way you still save a lot of money compared to a usual international bank transfer.

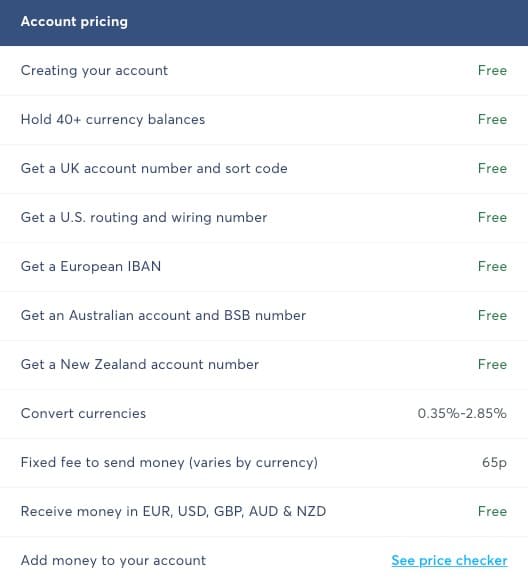

Again, fees are almost unbeatable:

Debit Mastercard

The next logical step after the Borderless account was to introduce a debit card. And that’s exactly what Wise did. Why? What are the advantages, you may ask?

Let’s assume you have been paid by someone in the UK into your Borderless account. Now you are travelling to the UK and are going to spend money there on food, hotels and much more.

Conventional way:

- International bank transfer into your local bank account (high fees!)

- Spending in the UK with your local credit card (in most cases you will pay a 1.75% currency exchange rate fee plus the exchange rate is worse than the market rate)

Borderless account + Debit card:

- Local bank transfer into your Borderless account (free!)

- Using your Debit card when visiting the UK and spending the GBP you have received earlier (free!)

If your GBP balance is finished, Wise will use any other available balance in your Borderless account and will convert it at their reasonable rates – which are usually lower than the typical 1.75% currency exchange fee with other credit cards. It, of course, depends on the exact currency your balance is converted from and to as outlined in those example conversions here:

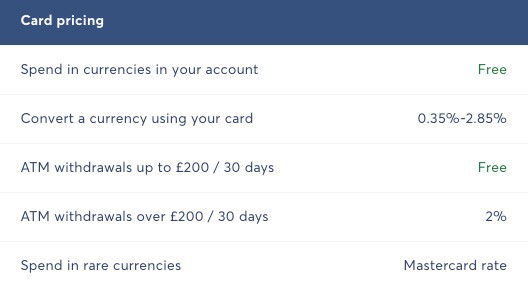

Cash withdrawals are also free on up to GBP 200 in 30 days. After that, unfortunately, fees will apply. Here’s a list of applicable fees connected to the Wise debit Mastercard:

Conclusion

Wise offers a multitude of useful services. As a freelancer and small entrepreneur dealing with international customers, this can make life much easier. Also, if you are travelling and spending in local currencies, this may be helpful to avoid high fees. I am certainly a huge fan of Wise and looking forward to what innovations they come up with next.